Call a Specialist Today! 877-352-0546

Call a Specialist Today! 877-352-0546

Free Shipping!

RSA Adaptive Authentication

A Comprehensive Authentication& Fraud Detection Platform

RSA Adaptive Authentication Technology & Components

Sorry, this product is no longer available, please contact us for a replacement.

Overview:

In order to meet end - user demand for convenience, organizations continue to extend product & service offerings and account access into online and mobile channels. At the same time, hackers continue to proliferate and ev olve, leveraging Phishing, Man in the Middle (MITM), Man in the Browser (MITB), and other sophisticated tactics to gain unauthorized access to funds, corporate data, and accounts. Achieving the right balance of security – without compromising the user experience – is a challenge for organizations. RSA ® Adaptive Authentication solves t his challenge by providing risk - based, multifactor authentication for organizations that want to protect users accessing web sites and online portals, mobile applications a nd browsers, Secure Sockets Layer (SSL) virtual private network (VPN) applications, web access management (WAM) applications, application delivery solutions, and Automated Teller Machines (ATMs).

Adaptive Authentication Overview

Adaptive Authentication is a comprehensive authentication and fraud detection platform. Powered by RSA’s Risk - Based Authentication technology, Adaptive Authentication is designed to measure the risk associated with a user’s login and post - login activities by evaluating a variety o f risk indicators. Using a risk and rules based approach, the system then requires additional identity assurance, such as out - of - band authentication, for scenarios that are high risk and violate a policy. This methodology provides transparent authenticati on for the majority of the users.

At a Glance

- Measures risk of login and post login activities by evaluating over 100 indicators in real - time

- Determines authentication requirements based on risk and policy

- Supports wide range of authentication options

- Provides cross channel protection of web - based & mobile applications, and ATM

- On - premise installation & hosted service options available

RSA Adaptive Authentication: Comprehensive, risk-based authentication and fraud detection platform that balances security, usability, and cost.

Strong Authentication RSA Adaptive Authentication takes a risk-based approach to enabling strong, multifactor authentication using device |

|

Emerging Threat Protection Protect against emerging threats in both web and mobile channels through a self-learning risk engine that adapts risk indicators. |

|

Flexibility Deploy as an on-premise product or as a software-as-a-service (SaaS) offering hosted by RSA. |

|

Confidence Increase users’ confidence and willingness to transact with online portals and mobile devices. |

|

Multiple Use Cases Protect different types of users accessing web sites and online portals, mobile applications and browsers, Secure Sockets Layer (SSL) and virtual private network (VPN) applications, and web access management (WAM) applications. |

Technology & Components:

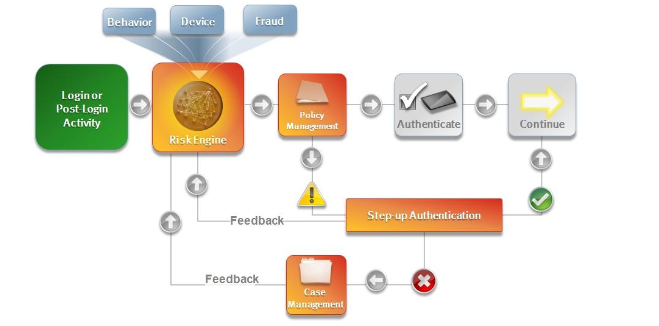

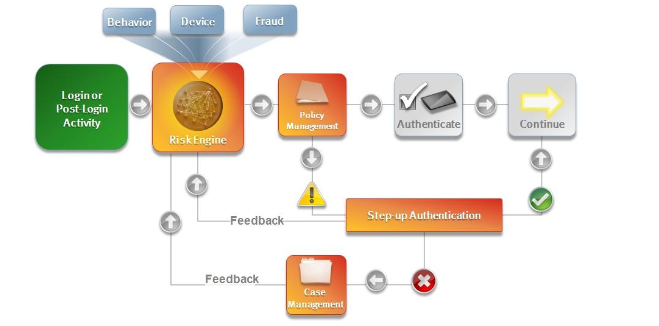

Adaptive Authentication leverages a series of technologies and components to provide cross - channel protection, including the RSA Risk Engine, RSA Policy Management, Device & Behavior Profiling, R SA eFraudNetwork ™, “Step - up” Authentication, and RSA Case Management.

RSA Adaptive Authentication Technology & Components

RSA Risk Engine

The RSA Risk Engine is a self - learning statistical machine learning technology that utilizes over 100 indicators to evaluate the risk of an activity in real - time. Adaptive Authentication leverages the Risk Engine to generate a unique score for each activity that ranges from 0 to 1,000, where 1,000 indicates the greatest level of risk. The score is reflective of device profiling, behavioral profiling, and eFraudNetwork data.

The Risk Engine combines rich data input, machine learning methods and authentic ation feedback to provide intelligent, real - time risk evaluations to mitigate fraud. Unlike most solutions, RSA takes both a risk and rules based approach. Customers can utilize the Policy Management application to set policy rules and that can be layered on top of the Risk Engine to create a hybrid approach.

RSA Policy Manager

The RSA Policy Management application translates risk policies into decisions and actions through the use of a comprehensive rules framework. For example, the Policy Management application can be used to set the risk score that will require later review in the Case Management application, prompt additional assurance or “Step - up” Authentication, and/or deny transactions in which the likelihood of fraud is very high. In addition, the Policy Management application can create rules independently of the risk assessment, such as blocking authentication from a specific IP address.

Device Profiling

Device profiling analyzes the device from which the user is accessing an organization’s w ebsite or mobile application. Adaptive Auth entication determ ine s whether a device used for a given activity is a device that is typically used by the user, or i f the device has been connected to previous fraudulent activities. Parameters analyzed include characteristics such as operating system version, browser type and version, and cookies and/or flash objects.

Behavior Profiling

Behavior profiling is a record of the typical activity for the user. Adaptive Authentication compares the profile for the activity with the user’s usual behavior to assess risk. The user profile is used to determine if the various activities are typical for that user, or if the behavior is indicative of known fraudulent patterns. Parameters examined include frequency, time of day and type of attempted activity.

RSA eFraudNetwork™

The RSA eFraudNetwork is a cross - functional repository of fraud patterns gleaned from RSA’s extensive network of customers, internal research lab, ISPs, and third party contributors across the globe. When fraudulent elements such as IP Address, Device Fingerprint, and/or Payee (Mule) Account are identified, they are shared with the eFraudNetwork. The eFraudNetwork provides direct feeds to the Risk Engine so when an activity is attempted from a d evice or IP that appears in the repository, it will be deemed high - risk.

Case Management

highly effective fraud management tool that enables the tracking of activities that trigger Policy Engine rules and determ ines if flagged activities are genuine or fraudulent. Organizations use this information to take appropriate measures in a timely manner and m inimize the damage caused by fraudulent activities. The Case Management application is also used to research cases and analyze fraud patterns, which are ess ential when revising or developing new policy decision rules. Further, this tool also enables an organization to provide feedback into the risk engine upon case resolution.

The Case Management API is an interface of Adaptive Authentication Case Management capabilities that allow an organization to share information with an external case management system. Consolidating cases into one system provides an organization with the ability to more efficiently confirm and resolve fraudulent activities.

Step - up Authentication

A step - up authentication is an additional factor or procedure that validates a user’s identity, usually prompted by high risk transactions or according to policy rules. The following are examples of out - of - the - box step - up authentication methods supported in Adaptive Authentication:

- Challenge Questions: Secret questions that have been selected & answered by end user during enrollment

- Out - of - Band Authentication: Onetime passcode sent to the end user via phone call, SMS text message or email. Transaction details can be included in the communication to help prevent fraudulent activities.

- Dynamic Knowledge - Based Authentication (KBA): Dynam ic questions that are unique to the end user, and generated from publically & commercially available data in real - time

- Other third party authentication methods via the RSA Multi Credential Framework.

Benefits:

Cross Channel Protection: Web, Mobile & ATM

Mobile Protection

The Proliferation of mobile devices brings opportunity as well as risk; however, mobile applic ations that directly integrate Adaptive Authentication protect against unauthorized access with m inimal impact to the end user. Adaptive Authentication offers a dedicated mobile risk model that includes capabilities such as location awareness and mobile d evice identification. Location awareness detects the location of the device using a series of time and geography based algorithms and can access location data gathered through Wi - Fi, cell - tower triangulation, and GPS. Device identification captures characteristics such as device model, language, and screen size. Anomalies such as locations or devices which are new to the user, are deemed high risk.

Adaptive Authentication offers integration through a web services call, or a Software Development Kit (SDK) that allows developers to build controls directly into their mobile applications. Supported platforms include Apple iOS, Android OS and Blackberry OS. Developers of mobile applications for business, banking, e - commerce and data access can now help inc rease security and confidence by integrating strong risk - based authentication in their mobile offerings.

Automated Teller Machine (ATM) Protection

ATM - based attacks, such as Account Takeover and Mule Withdrawal Attacks, are on the rise; with Adaptive Authentication banks are able to detect and monitor these threats without requiring additional software on their ATM machines. Adaptive Authentication analyzes ATM - specific activity including date and time of access, transaction amount , frequency of withdrawal, ATM owner and ID and location of ATM in order to assess risk

Advanced Threat Protection

Organizations are constantly battling new forms of threats. Adaptive Authentication is designed to address Man in the Browser (MITB) and Man in the Middle (MITM) techniques employed by the latest Trojan attacks that aim to comprise end user accounts by detecting the use of proxies, automated scripts, and HTML injections. With Adaptive Authentication, anomalies are flagged so that an organi zation can take action to block, monitor or require additional authentication measures to complete an activity. Adaptive Authentication reviews the activity per user and per population to understand the behavior of the website as a whole.

- Proxy Attack Detection: Cybercrim inals utilize proxy attacks to log on to an account from a Proxy IP address, gaining positive device identification by appearing as though the activity is com ing from the genuine IP address. RSA Adaptive Authentication determines when login or post login activity is being performed via a proxy, and if this is anomalous to typical behavior, adjusting the risk score appropriately

- Automated Script Detection: Some Trojans, such as those used during an MITB attack, automatically conduct account activities without manual intervention. Adaptive Authentication defends against Trojans using automated script attacks to fraudulently add payees, transfer money to mule accounts, change address, and the like. RSA Adaptive Authentication software utilizes innovative Man vs. Machine protection to determ ine whether mouse or keystroke movements are associated with data input. Additionally, the RSA Adaptive Authentication solution differentiates between users who have the browser auto complete feature turned on and can adjust the risk score accordingly.

- HTML Injection Detection: HTML injections are commonly used to gather user credentials through an added field in a users’ browser display and manipulate balance page. Adaptive Authentication detects and flags fraudulent changes to end users’ browser displays which attempt to either manipulate payments or harvest additional user credentials like social security number, credit card number, or PIN.

Flexible Deployment & Configuration

RSA recognizes that no two organizations share the exact same user authentication needs, and as a result, Adaptive Authentication offers a wide array of deployment and configuration options to meet the varied needs of organiza tion s . For instance, o rganizations worldwide currently deploy Adaptive Authentication in two ways – as an on - prem ise installation that uses existing IT infrastructure or as a hosted Software - as - a - Service (SaaS) . Further, Adaptive Authentication can be co nfigured in a number of ways to balance security and risk without compromising the user experience. Many organizations currently provide risk - based authentication for their entire user base and use the Policy Management application to determ ine action to take based on risk. This flexibility enables Adaptive Authentication be used to protect a variety of remote access points such as web portals, SSL VPNs, and ATMs.

Documentation:

Download the RSA Adaptive Authentication Data Sheet (PDF).

Pricing Notes:

- Pricing and product availability subject to change without notice.